The named entities or Blockchains set forth below do not represent recommendations to purchase or in any way reflect investment advice. One of the key variables that is critical for deciding to invest is missing. That variable is the current valuation of each token or asset vs the overall market and a reasoned forecast of future performance vs the market. What is presented below attempts to inform and to encourage research, to learn about each, and to come to an opinion of whether any of them or all of them strike you as being an important participant in the future development of digital asset platforms. Charts of technical price levels and movements are presented to educate those unfamiliar with price patterns. These examples of real price activity show how prior price levels may be used to identify market points of price resistance or support. Use this information as you see fit, but it is recommended that you see this as an educational/informative tool only. This information is only part of the array of focus areas needed in making any investment decision, accordingly, it is best to not rely on one type of analysis for your capital allocation decisions.

The market will tell us when to invest

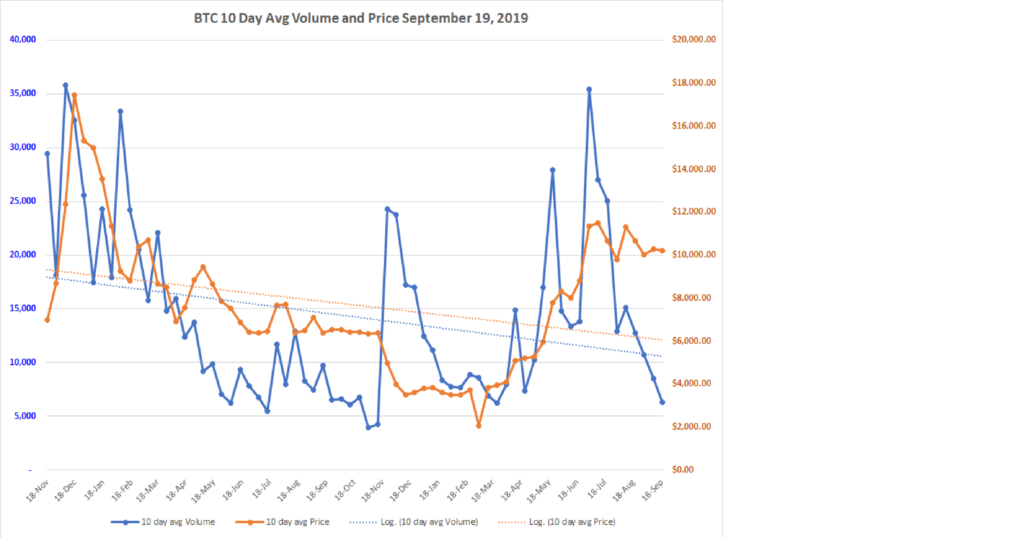

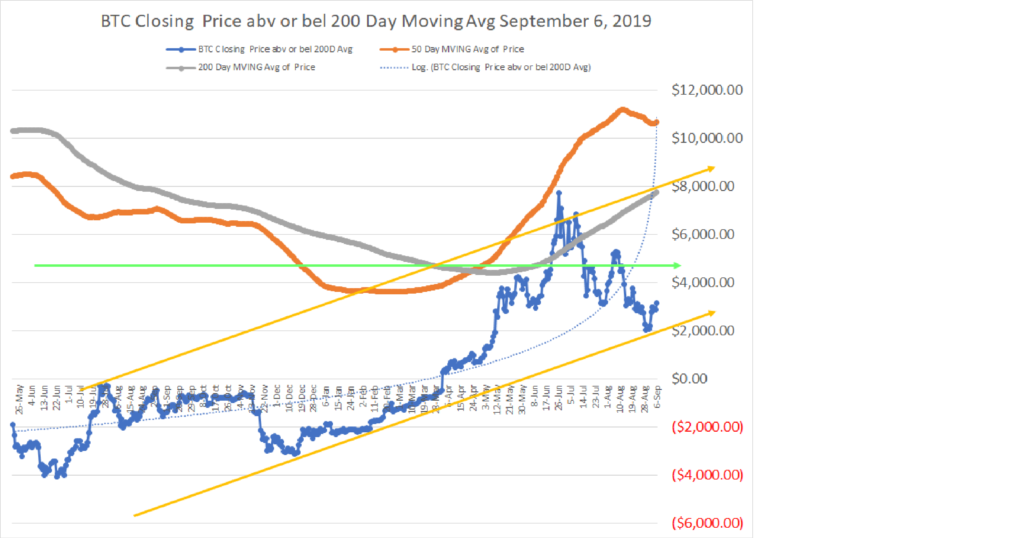

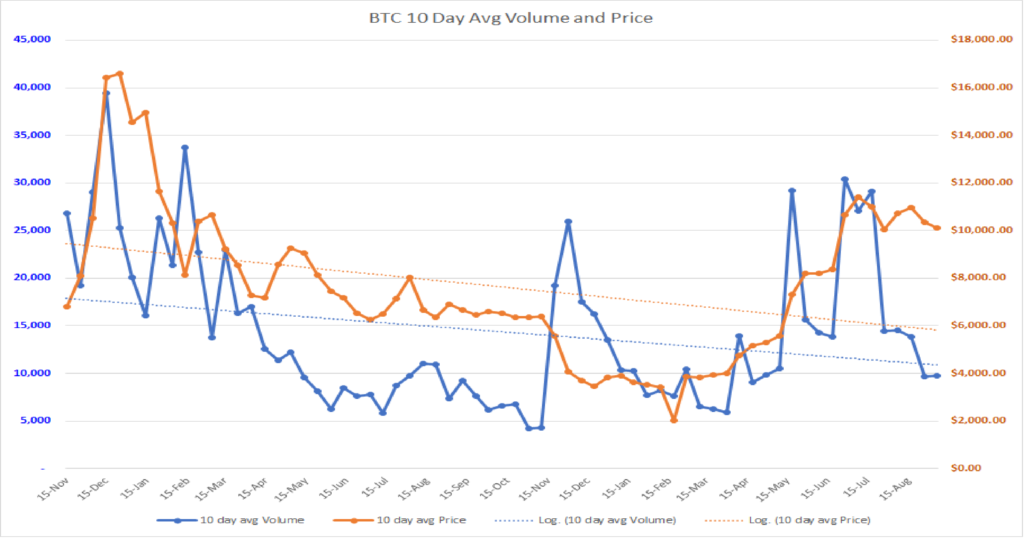

As I noted, the compression of pricing and the decline in volatility were at points that strongly indicated a breakout in prices was imminent. The move could have been higher or lower, but regardless of direction, it was going to be meaningful. My initial observation that BTC had established a new bottom at the $9,000 level was proven wrong.

Well now we know which way the price move took: the break was lower.

This makes sense given the launch of BAKKT futures this week. The weeks leading up to this were characterized by low volume and steady to lower prices. The action of accumulation in anticipation of the BAKKT launch was missing, and this was an indication that institutional demand pre-launch was lacking. The small number of Bitcoin futures that traded on opening day was a disappointment to the market, and the ensuing price declines reflected that disappointment.

What now?

Keep your powder dry. Let the selling exhaust itself. The large volume traded on September 24, 2019 of the crypto-currencies was not record setting, but was meaningful compared to the volumes during the prior time of July through mid-September. Once the dust settles, and there is price and volume stability or a reversal to the upside in price accompanied by volumes greater than the 30 and 60 day averages, then we should consider scaling into new long positions. This will mitigate risk at the cost of missing the early part of the price rise, but in the long-run will serve us well in letting the market confirm price direction on which we may ride the coattails to increasing wealth.

Yesterday, for many, likely felt like my daughter did in this video.